The Path Forward

Significant engineering efforts have gone into creating multi-chain products, reliant on the native issuance of tokens across different networks.

While this is a noble cause, Synapse offers a simpler solution for secure, decentralized bridging of funds.

Synapse’s integration with GMX has done exactly that, helping to bridge liquidity between the two blockchains and in turn increasing interoperability and enabling on-chain derivatives-trading for more users. Synapse has already exceeded $39B in total transaction volume, which is only the beginning.

Introduction

GMX revolutionized on-chain derivatives and spot trading markets with zero-slippage trades on the Arbitrum network. To access new user bases, they began a multi-chain strategy starting with the Avalanche network in late 2021. Rather than using native bridges with Ethereum as an intermediary step, GMX chose Synapse Protocol to launch their native GMX token on Avalanche

The result is that GMX already has the 4th-highest total value locked on Avalanche, and sees no signs of stopping. What follows is an in-depth look into how GMX built on top of Synapse to address security, acceptance, compatibility, and efficiency, making it clear why reliance upon Synapse is the path forward for future protocols’ multi-chain solutions.

The Challenge of Wrapped Tokens

BTC exists natively within the Bitcoin network, ETH exists natively within the Ethereum network, and AVAX exists natively within the Avalanche network. As the number of blockchains and assets grows, so does the need for cross-chain compatibility. Wrapped tokens address this by enabling a given token to be represented on a separate network.

Wrapped tokens confer many advantages, but also some inefficiencies:

Fragmented Liquidity: different versions of a token fragments liquidity across networks. For example, blockchain networks often have various versions of wrapped ETH and BTC.

Security: when smart contracts on either network become compromised, all tokens become worthless. In 2022 alone, bridge hacks exceeded $2B.

Centralized Exchange (CEX) Compatibility: centralized exchanges such as Binance or CoinBase are often incompatible with wrapped tokens due to liquidity and security issues, as seen above.

Inefficient Bridging: wrapped tokens may need to be swapped for native tokens in order to realize CEX compatibility and liquidity benefits.

As such, many including Vitalik Buterin have argued that the future is multi-chain rather than cross-chain, whereby tokens exist natively on various blockchain networks.

Although designing a wrapped token that solves for the above issues is not trivial, GMX was able to achieve wild success by building on top of Synapse.

Synapse and GMX

GMX first launched on Arbitrum, providing spot trading and leveraged perpetual swaps (a form of derivative) with zero slippage. This unique feat led to significant growth as prior to this, traders were either subject to slippage or restricted in their ability to leverage up. In 2022 alone GMX grew from a TVL of ~$107M all the way to ~$461M, while the DeFi market as a whole fell from ~$170B down to ~$39B.

GMX soon decided to expand onto the Avalanche network for its high throughput and low fees, both important factors for fast oracle updates and high trading volume.

They, therefore, were faced with a decision:

Launch GMX natively onto Avalanche: This would cost significant time and developer resources, but provide all the benefits of a native token.

Wrap GMX tokens: this would be much faster and cost-effective, but be subject to the downsides of wrapped tokens.

Synapse Protocol made it clear that not only could GMX quickly bridge onto Avalanche as a wrapped token, but that it would be essentially equal to a native token.

This soon became true: GMX launched upon Avalanche in late 2021 and has already become ranked 4th by TVL according to DeFiLlama.

Let’s explore each drawback of wrapped tokens in turn, and how the current design has solved them.

Fragmented Liquidity

The Synapse supported version of GMX is the only one on Avalanche, meaning that liquidity is not impacted. Any future plans to launch another wrapped version of GMX would require governance support from Avalanche, and would be unlikely to pass due to the existing GMX token being sufficient for all existing needs, with ample liquidity as well.

Security

Bridge architectures tend to rely on three methods of verification:

Locally verified: only parties involved in a given cross-chain interaction verify transactions.

Natively verified: all validators of the two blockchains involved in a transaction verify the message.

Externally verified: an external validator set verifies transactions between chains.

Synapse relies upon a secure proof-of-stake mechanism and is moving to an optimistic verification structure, an idea stemming from optimistic roll-ups, whereby security is maintained as long as there is a single honest party. This is a novel way of bridging assets in a decentralized manner and is very secure because now only one actor can prevent fraud on the network. In fact, most roll-ups (layer-2’s) rely upon optimistic architectures.

3. CEX Compatibility

Despite being wrapped, only a single version of GMX exists on Avalanche, meaning it has wide recognition, and as such has been accepted by centralized exchanges, showing their faith in Synapse’s security. Popular CEXs such as Binance and Coinbase now easily withdraw or redeem Avalanche-based GMX, significantly increasing liquidity and ease of access.

4. Inefficient Bridging

Due to GMX on Avalanche being treated comparably to a native token, there is no need for users to swap tokens once it is bridged. Through Synapse Protocol, users know their tokens will be bridged seamlessly and securely between networks of their choice and that inefficiencies are non-existent. No swaps, liquidity pools, or incentives are required; the user starts with GMX and ends with GMX in one transaction. Oftentimes bridges can take up to 7 days, whereas with Synapse transactions are executed within 3 minutes.

5. User Experience

An additional benefit of GMX’s integration of Synapse is that users interact with a clean interface when bridging between blockchains. In contrast, many bridges have confusing UX which can lead to challenges such as missing funds. For GMX, using Synapse means that liquidity pools are not required on the destination chain, as users can swap GMX directly between Arbitrum and Avalanche.

A look into the Data

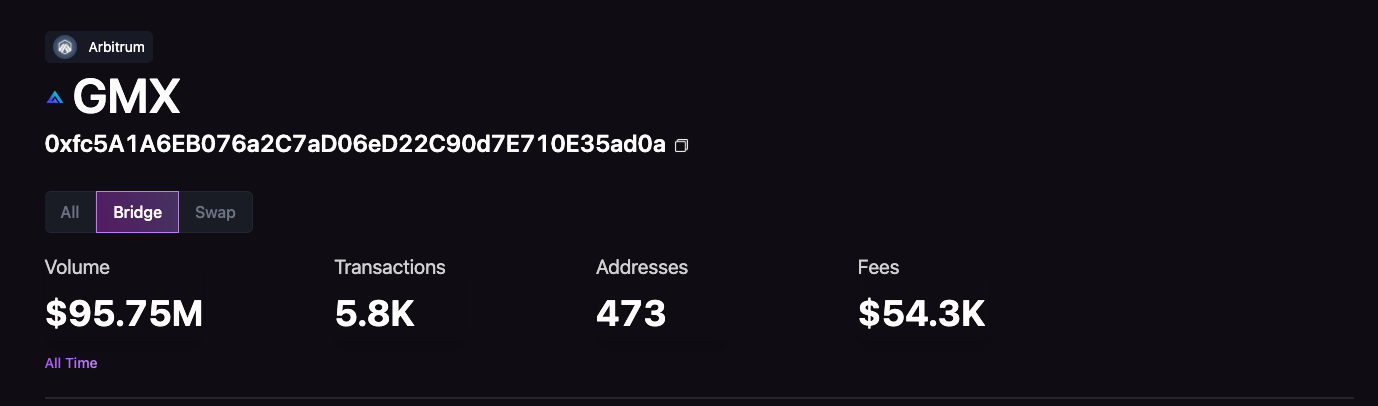

As of April 2022, bridge volume has exceeded $95M and can be viewed using Synapse Explorer’s GMX-specific page.

It’s in fact possible to examine Arbitrum-Avalanche transactions in-depth, including specific users and their activity.

In total, 457 users have executed nearly 5,000 transactions, demonstrating the power-law nature of bridging and trading. Expect bridging to grow significantly alongside the on-chain perpetual swaps market.